Pitching. Another brilliant idea (that probably won’t see the light of day)

10 Feb 2026

I’ve been consulting to brands on their choice of agency partners for 28 years, during which time I’ve heard all the arguments on how to improve the pitch process and made a few suggestions myself.

My latest focusses on the global behemoth pitches that last months, sucking the life out of the agency pitch teams involved.

These global opportunities are too commercially significant for either the incumbent or competing agencies to ignore, hence all will always raise their hands when invited to pitch - be it a creative, media or a multi-discipline, all-up-for grabs opportunity.

Can we avoid boiling the ocean?

For what are understandable reasons, these pitches have become a shopping list of requests which need to be completed, including but not limited to…

- A written response to an initial RFI in which granular information is to be provided about all agency capabilities across multiple markets.

- A series of chemistry meetings in which client teams meet agency teams at the centre as well as in the key client markets.

- An RFP is then issued to three, usually four, and sometimes five Holdco's that will consume the pitch team’s full attention for the foreseeable future, as well as all the subject matter experts across the Holdco that will need to contribute.

- Pitch briefs are issued that will require strategic and executional responses, often across multiple brands and markets.

- Separate and parallel investigations will take place into specialist capabilities that are of interest – data analytics, sponsorship, shopper marketing, search, econometric analysis, media mixed modelling, CX and UX capabilities, and the ubiquitous questions of all things AI related.

- Then there’s the compliance, governance, and legal requirements, some of which is understandably highly detailed - particularly in regulated business sectors.

- There’s a workstream on the operational requirements including transition and delivery. Add to this the technological aspects that will form part of the governance required to ensure Martech and AdTech engage effectively.

- Who is going to be working on the business? What’s the team structure across the different brands and markets and what’s the operating model that will best suit the client circumstances?

- Then, in the case of media pitches, there’s the not insignificant matter of media pricing and quality guarantees, together with all associated media trading considerations that will form part of an agency’s fully loaded pitch response. All delivered across multiple markets.

- And finally, although I’m sure there’s other stuff I’ve not covered, there’s the commercial response to the brief for the next two or three years. Broken down by market and service line.

Each of these requires significant investment in resource and hard costs, from the Holdco, agency and client teams alike, which explain why such pitches can take as long as they do - usually more than six months and sometimes stretching to a year.

Now, I’m not saying all of the above isn’t important but here’s a suggestion that will save money, resource, time, and - I think most importantly - not at the expense of a lesser outcome.

The assurance insurance challenge

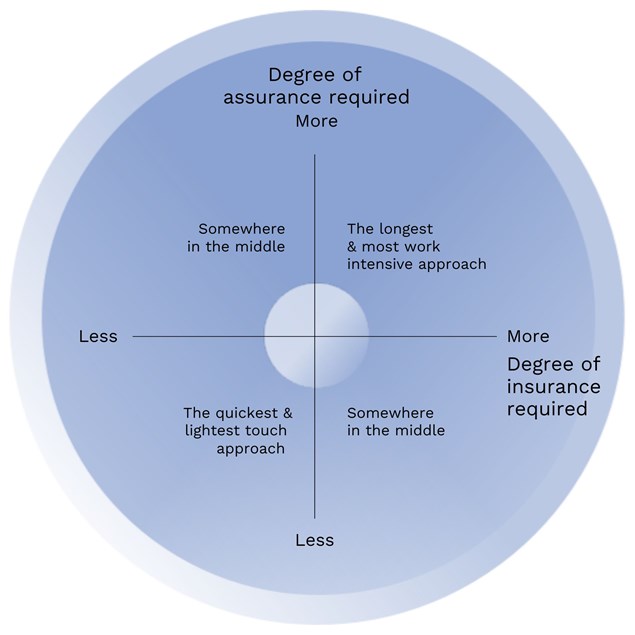

All partner agency selection requires a combination of assurance and insurance. Assurance can be gained through an agency’s relevant current and past evidence, essentially a demonstration of what the agency has already achieved for other clients.

Insurance is derived from the confidence in an agency’s ability to deliver on a future promise of what the agency can do for the client pitching their business. Essentially, this is the original thinking and work created in response to the pitch brief.

The circumstances and requirements of each client are individual, with the consequence of time and effort required illustrated here.

No agency should be invited to pitch if it cannot meet the client’s hygienic requirements (e.g. category, challenge or audience experience, geographic footprint, specific expertise within the agency or wider Holdco family and more). All this information can be gleaned from agencies without too much effort to provide it.

The evidence would indicate that on their day, any Holdco or agency can beat any of their competitors, as demonstrated by the movement of global clients over the past few years. There are times when a purple patch is enjoyed (as would seem to be the case with Publicis Groupe at the moment) but the overall quality offered by the best in the market is of a very high standard.

Therefore, whichever Holdco’s or agencies are invited to pitch, as long as sufficient due diligence has been undertaken to satisfy the required level of assurance, all will be capable of doing an excellent job for the prospective client.

A radical suggestion

Having identified the Holdco’s or agencies to invite to pitch, all of which have met the assurance threshold, what if the pitch brief was limited to a maximum of two areas into which a deep dive exploration is undertaken, plus a commercial and operational proposal to an agreed MSA?

So, from the above illustrative shopping list of pitch requirements against which a brand needs insurance, two are chosen for pitching agencies to address in their pitch response.

It could be the challenge faced by a particular brand; or how data can be used to target audiences with more relevant messaging; or a new communication platform; or launching into a new market; or employing technology to improve the operational efficiency of delivering global campaigns; or whatever else is important to the brand and affords the pitching agencies the opportunity to shine.

But, crucially, it’s not all of the above. In other words, the degree of insurance required is limited rather than the pitching client requiring a response that encompasses all the colours in all the sizes in all the territories and languages.

What’s the worst that can happen?

On the face of it, such a suggestion could be accused of being unrealistic and lacking an understanding of how corporations and global businesses go about assessing and procuring agency partners.

What’s the worst that can happen if such an approach were to be taken?

The upside is a streamlined approach that balances the right levels of assurance and insurance required by the client team to make an informed, confident choice. The time, effort and resources saved would undoubtedly be welcomed by all.

And if this approach proves to be unsatisfactory, then there’s still the option to ask for more, safe in the knowledge that agencies are likely to respond to any and all requests to convince prospective clients to pick me.

But wouldn’t it be great if just one of the behemoth businesses were to try this approach to see if it works.

I’d wager a small beer that it does!

About The Author